Gone are the days when robots were confined to the automotive industry and sci-fi movies. Today, North America and Europe are booming with robotics and automation companies, providing solutions to most industries and making the list of choices for end-users seem almost endless.

Over the past ten years, the number of robotics and automation suppliers on the two continents has increased by more than 22% to a total of 8,569 robot manufacturers, integrators, distributors, component suppliers, and advisors according to new data from HowToRobot. The growing supply of robotics is also becoming evident at tradeshows such as the Automate Show in Chicago, which expects 33% more exhibitors this year than the last.

“The technology and solution choices for businesses looking to automate have expanded incredibly in recent years,” says HowToRobot CEO, Søren Peters, elaborating:

“On one hand, this is great news, as businesses may find fewer and fewer applications out of reach for automation. But we also see the immense number of options is increasingly overwhelming— especially for those new to automation.”

Overwhelm driving demand for better planning

One key challenge of having many automation options is simply knowing where to start. As robot adoption is expected by the International Federation of Robotics to grow by 7% annually in the coming years, it’s becoming increasingly important for businesses to have a roadmap for automation in place.

“Going shopping for robots without a plan for where to start often leads to either choice paralysis or not investing where it benefits the business the most,” says Søren Peters.

“We see a growing demand among businesses for help identifying the right automation opportunities before they contact suppliers for solutions,” he adds.

After having a plan in place, a common challenge is identifying the most relevant automation solution providers—a challenge highlighted by 42% of businesses surveyed by McKinsey. With many possibilities to choose from, knowing how to differentiate is key according to Søren Peters:

“Having many solution choices makes it increasingly important for businesses to know what they want to achieve from automation so they can evaluate the solutions accordingly,” he says.

“Investing in new technology, there’s always the risk of paying for extra features that are not essential to the purpose of automating. We see more and more businesses put specific goals and performance criteria in place to help prevent that,” he adds.

A growing need for transparency and standardization

A related consequence of the growing number of robotics and automation suppliers is a push towards greater transparency and standardization.

While automation has historically been a typical job for custom machine builders, the increasing competition is paving the way for more standardization.

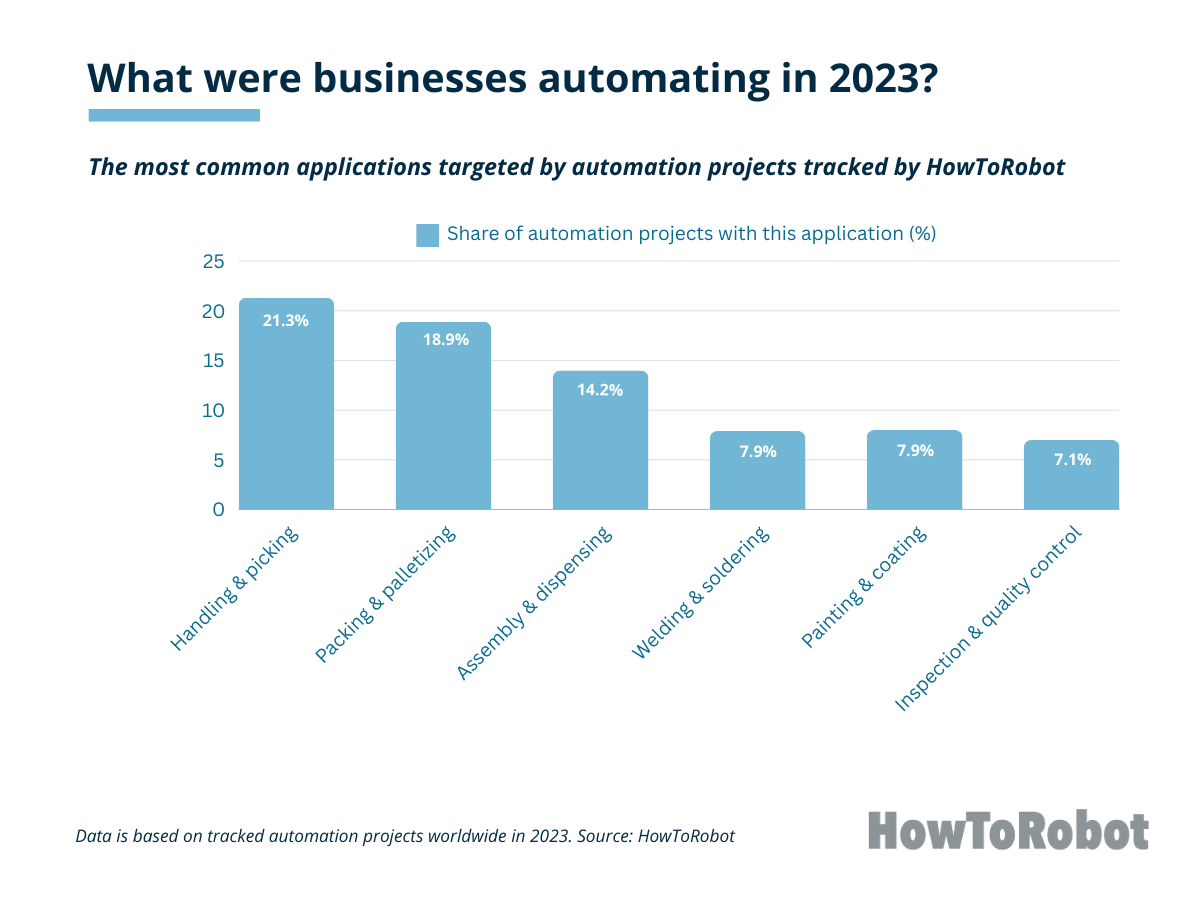

“In a competitive market, customers seem to favor standard solutions, as these are often perceived to be less complex and therefore also more affordable,” says Søren Peters, adding that this especially applies to the most common applications for automation, where competition is strongest.

Another reason that the market tends to favor standardized solutions, according to Peters, is that they are also perceived to have a shorter lead time. HowToRobot recently revealed new data showing that most automation projects have relatively short deadlines of 6 months or less, which gives solutions with quick delivery and implementation an advantage.

Finally, “standardization also brings transparency,” Peters adds.

“Businesses are often struggling with understanding the cost of automation and comparing prices across solutions. When solutions become standardized and are given a transparent price tag, it sends a signal to customers that it’s safer to buy. Ultimately, that helps drive buying decisions,” he concludes.